Table Of Content

Get updated information on COVID-19 immunizations, how COVID-19 is impacting health plans, expanded FMLA leave coverage, and more in this issue of our newsletter. Watch this video to learn how to find and use a health care provider who accepts the TrueCost Plan. Complete and submit all clinical data and MD orders for the request. A determination will be made based on medical necessity, member eligibility and available benefits. What’s the difference between in-network coinsurance and in-network copayment? Get the definitions to these common health coverage terms and more in our glossary.

MEMBER SUPPORT

In addition to traditional PPO plans, they offer TrueCost, a reference-based price plan, which uses a unique, copay-only plan design. This simplifies administration and keeps overall costs down for the employer and its employees. Additionally, they offer a full suite of Consumer Driven Services administration for services such as COBRA administration, FMLA and Short Term Disability leave administration, and FSA/HSA administration. CDB is dedicated to delivering innovative cost containment solutions like TrueCost and TrueCost Rx to our clients. The unique copay-only plan design removes the complexity from the payment process by eliminating coinsurance and deductibles, while simultaneously controlling costs.

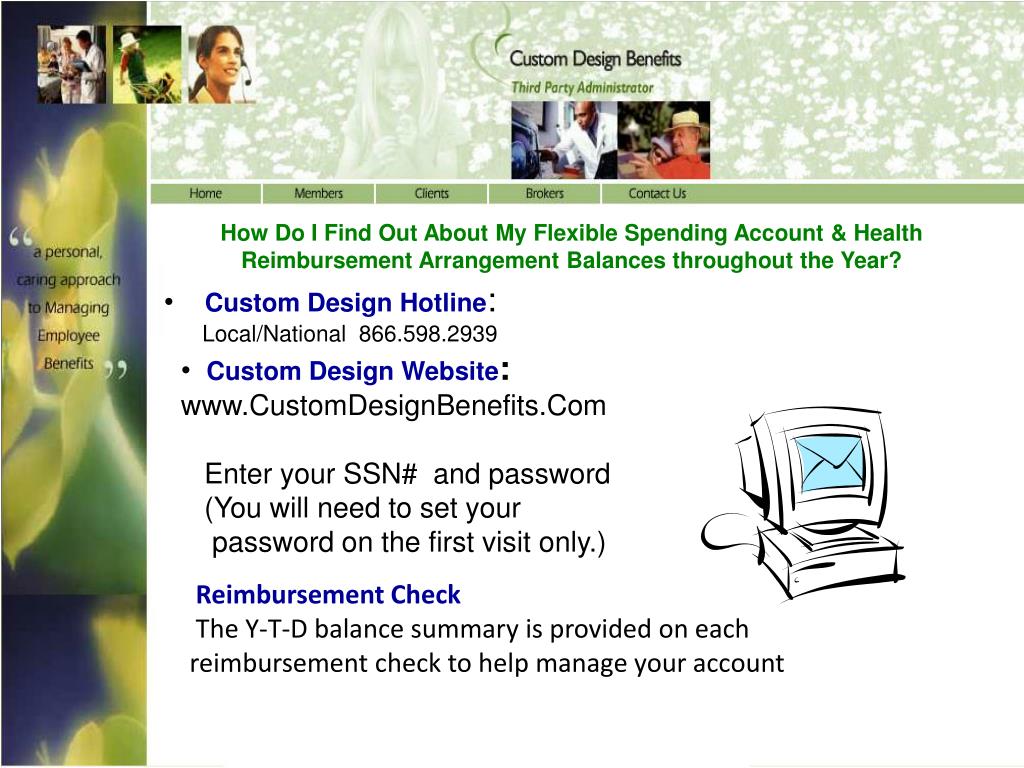

Custom Design Benefits FSA/HSA

We do not knowingly collect or store personal data provided by anyone under 13 years of age. They have case managers reaching out to our most vulnerable participants, providing guidance and direction as they combat serious medical conditions. Access user-friendly analytics and reporting tools to see how well your plan is performing for your member population and visualize savings strategies for decision-making. Fill out the form below if you are a broker and want to learn about Custom Design Benefits products and services. What documentation do I need to submit a claim and is the cost of gas to and from work covered?

Become a CDB Partner

For almost three decades, the company has worked with employers to create personalized benefits programs that keep administration costs low and maintain compliance without any of the hassle. In addition to a host of other services, the company offers COBRA and leave management administration services that can take away the pressure of navigating tricky new coronavirus-related regulations. Flexible health plans and benefits administration services designed to help employers take more control over costs and offer the perks that can attract and retain talent. In this episode of the DH+ INSPIRE podcast, we had the pleasure of enjoying an insightful conversation with Custom Design Benefits CEO and President Julie Mueller.

Making Employees Happier and Healthier is Our Business

We offer complete administration of self-funded plans for medical, dental, and vision care with pharmacy benefit manager (PBM) integration, flexible spending accounts, and much more. Learn more about the benefits employers, employees and health care providers can experience with transparent and fair reimbursement. In this special anniversary issue of the Custom Design Benefits newsletter, celebrate with us as we observe 30-years of service! You can also learn about specialty pharmacy costs, near-site clinics, mental health care solutions, and other discussion topics from our 14th Annual Customer Conference. Anthem is the City's medical AND pharmacy provider for both the 80/20 Plan and the HDHP Plan.

There’s a better way to combat rising health care costs than using ineffective and outdated cost-shifting strategies. Find out how an insurance plan that combines self-funded insurance and a traditional insurance plan could potentially save employers 25-50%. Custom Design Benefits offers two health reimbursement arrangement options – a qualified small employer HRA and individual coverage HRA.

What is Population Health Management and how can it be used to combat the rising cost of health insurance? Read about five cost levers employers can use to offer improved benefits while keeping costs in check. Learn about FSAs and how you can save $25-40 for every $100 you spend on health care services.

Panel discussion: HR in the age of COVID – “Sometimes more complicated than rocket science” - Cincinnati Business ... - Cincinnati Business Courier

Panel discussion: HR in the age of COVID – “Sometimes more complicated than rocket science” - Cincinnati Business ....

Posted: Tue, 09 May 2023 07:00:00 GMT [source]

I’m typing in my username and password but continuously getting a sign in failed message. I know I’m using the correct login information because I have it open in front of my on my desktop. Was wanting to use the app for the scanner option to see if certain items are eligible for FSA. I was excited to try the app, but very disappointed that I can’t even log on. Get started creating a plan that delivers more for your employees without paying extra. To help you stay informed, we created The Custom Design Benefits Insider – an educational resource for Custom Design Benefits employers and brokers.

Hear What Our Clients Have to Say

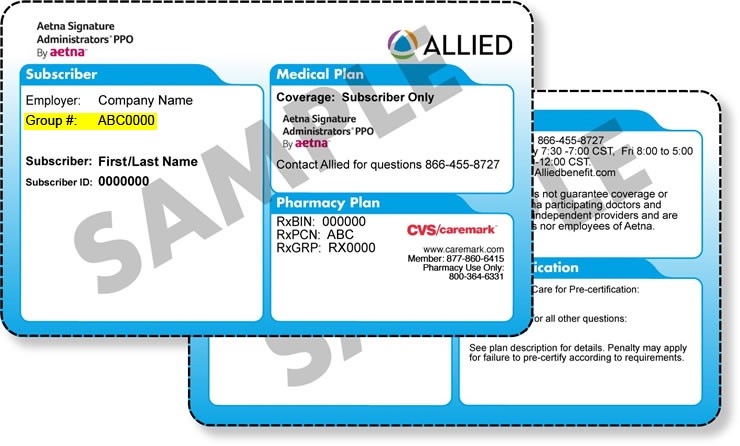

Log into the portal below to access secure claims and payment information and verify eligibility. We specialize in administering wage parity benefits with our state of the art card technology. Custom Design Benefits is a common health insurance in Ohio,and individuals who have Custom Design Benefits may wish to find therapists who are in-network with their health insurance.

My new employer offers coverage through a carrier, so I must make the switch, but CDB is now the gold standard by which I will measure the coverage and service offered by any healthcare provider. Find out how self-funded health plans can offer your company several benefits, such as improved cost-savings, benefits flexibility and more. Find out how reference-based pricing plans can give employers access to provider direct contracts to more accurately predict healthcare costs. Watch this video to learn how a hybrid insurance plan (HIP) utilizes the best of two plans, fully insured and self-funded insurance, to offset rising premiums and avoid cost-shifting to employees. From reference-based pricing to Ted Lasso and mental health, here’s a look at some of the headlines and issues that are impacting health care and benefit plans.

You can also download a print version of the packet, which includes all benefit required notices, for employees who will not have immediate access to email. Access your claims data and plan analytics to better understand what is driving costs and take action. We help organizations break free from cookie-cutter insurance plans and never-ending cost increases. Make sure to ask these questions from selffundingsuccess.com before deciding whether to take the next step with a self-funded insurance plan. A Hybrid Insurance Plan (HIP) provides flexibility and creativity to manage healthcare costs.

Highlights include a 2019 year in review, results from our Customer Satisfaction Survey, updates on our Direct Primary Care pilot program, Flexible Spending Account contribution changes, and more. Find out how you can save money on dental and vision care with a Limited Purpose FSA. When are funds available and what documentation do I need to submit a claim? Get answers to all these questions and more in our dependent care FSA FAQ.

How can the removal of waste from drug formularies help companies and employees achieve savings? Download this guide from the John Hopkins Drug Access and Affordability Initiative, the Pacific Business Group on Health, and Integrity Pharmaceutical Advisors to find out. What expenses are eligible and what documentation do I need to file a claim? Get the answers to all these questions and more in our limited healthcare FSA FAQ. Specialty alternative funding solution provides up to 58% savings on specialty medications. Learn more about the benefits businesses of all sizes can experience with an individual coverage HRA (ICHRA).

In addition to cost containment, companies that work with Custom Design Benefits also enjoy personalized attention and ongoing working relationships with highly engaged employees. Even as the team had temporarily shifted to a work-from-home model in light of pandemic restrictions, its employees continued to provide the same level of top-tier service. If Custom Design Benefits administers your self-funded Medical, Dental or Vision Benefit Plan, you can access secure benefits information by logging into the Employer Portal. Online eligibility changes, additions and terminations can also be entered with this portal. You can access finance information by logging into Executive Analytics. Log into the Custom Flex Portal for spending accounts and COBRA Portal for COBRA administration.

Learn more about the benefits of CDB’s population health management services and how you can implement strategies to keep employees healthier. Custom Design Benefits offers our health care provider partners an automated IVR system to access member information. Get more information about how TrueCost works to reimburse health care providers at an appropriate amount and how to make sure your doctor accepts the plan. Learn how evidence-based pharmacy risk management can combat wasteful drugs on formularies to provide safe and effective medications while reducing plan spending in this article from L.G. Hanzel, a pharmacy risk management strategist and RxResults, a joint collaborative with the nationally recognized University of Arkansas for Medical Sciences.

TrueCost Rx, a prescription benefit management solution, provides savings over traditional PBM models through member education, medical management, and specialty drug prior authorizations. Well-designed plans that focus on population health, prescription drug costs and other cost control strategies can have a positive impact on employers and their employees. Find out how our customized plans can provide the flexibility needed to address your specific financial and health care concerns. When you see a therapist who is in-network with Custom Design Benefits, each session you’ll pay only a copay,which typically ranges from $0-$75/session. Insurance companies and employer-based health plans must submit information about prescription drugs and health care spending. From new strategies for controlling health care costs and recruiting and retaining top employees, to changing regulations and compliance issues, employee benefits plans are constantly evolving.

No comments:

Post a Comment